Credit card fraud detection using ensemble data mining methods

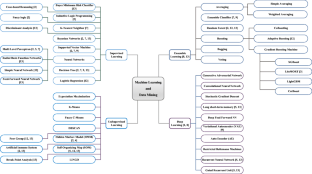

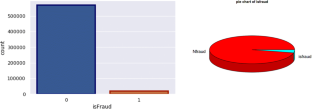

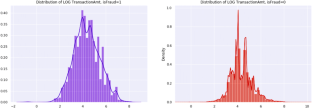

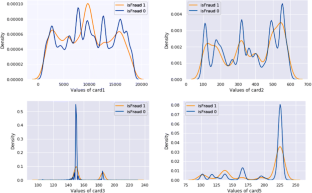

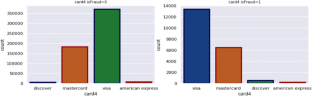

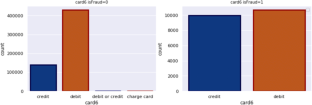

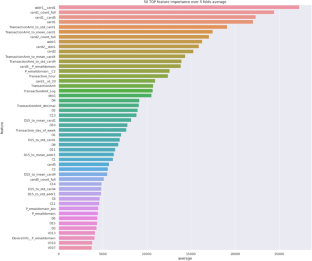

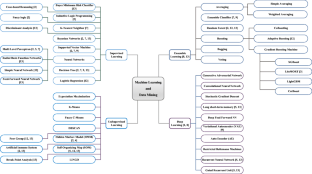

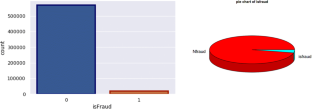

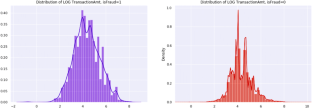

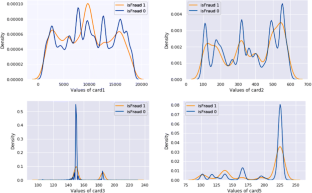

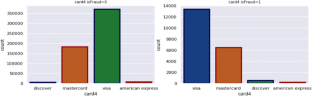

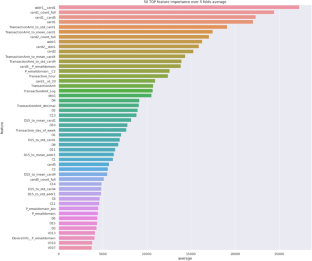

Nowadays, credit card fraud has become one of the most complex and vital issues in the world, even more than the past decades. Widespread use of credit cards is one of the most attractive forms of online transactions in the banking sector. Credit cards’ attractiveness is the ease of life for people, which allows customers to use their credit at any time, place, and amount, without carrying cash and without the hassle of carrying cash. This is to make it easy to pay for purchases made via the Internet, mobile phones, Automated teller machines (ATMs), etc. Meanwhile, financial information acts as the main factor of financial transactions in the market. Due to the popularity of using credit cards, various security challenges are increasing, and this issue has intensified fraud intending to obtain unauthorized financial benefits. Researchers have proposed different solutions for detecting and predicting credit card fraud, which has been successful. One of these methods is data mining and machine learning. The issue of accuracy in predicting problems is vital in this regard. In this study, we examine Ensemble Learning methods, including gradient boosting(LightGBM and LiteMORT), and combine them by averaging methods(Simple and Weighted Averaging methods) and then evaluate them. Combining these methods reduces error rates and increases efficiency and accuracy. By evaluating the models by Area under the curve(AUC), Recall, F1-score, Precision, and Accuracy criteria, we reached the best results of 95.20, 90.65, 91.67, 92.79, and 99.44 for the combination of LightGBM and LiteMORT using weighted averaging, respectively.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save

Springer+ Basic

€32.70 /Month

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Buy Now

Price includes VAT (France)

Instant access to the full article PDF.

Rent this article via DeepDyve

Similar content being viewed by others

An Ensemble-Based Machine Learning for Predicting Fraud of Credit Card Transactions

Chapter © 2022

Investigation into the Efficacy of Various Machine Learning Techniques for Mitigation in Credit Card Fraud Detection

Chapter © 2021

Analysis of Credit Card Fraud Detection Using Fusion Classifiers

Chapter © 2019

Explore related subjects

Data availability

Data sharing not applicable to this article as no datasets were generated or analyzed during the current study.

References

- Abdulrazaq AA, Abdulrazaq MB, Umoh IJ, Adedokun EA (2019) "Fraud detection in credit card and application of VAT clustering algorithm: a review," in 2019 2nd international conference of the IEEE Nigeria computer chapter (NigeriaComputConf)

- Alicja G, Bakala M, Woznica K, Zwolinski M, Biecek P (2019) "EPP: interpretable score of model predictive power.," arXiv, p. preprint arXiv:1908.09213

- Altyeb Altaher T, Malebary SJ (2020) An Intelligent Approach to Credit Card Fraud Detection Using an Optimized Light Gradient Boosting Machine. IEEE Access 8 8:25579–25587 ArticleGoogle Scholar

- Arya M, Hanumat SG (2020) DEAL–‘deep ensemble ALgorithm’Framework for credit card fraud detection in real-time data stream with Google TensorFlow. Smart Sci 8(2):71–83

- Ayyadevara VK (2018) "Gradient Boosting Machine," Pro Machine Learning Algorithms. pp. 117–134

- Bagga S, Goyal A, Gupta N, Goyal A (2020) Credit card fraud detection using Pipeling and ensemble learning. Procedia Comput Sci 173:104–112

- Chen Y (2020) "LiteMORT: A memory efficient gradient boosting tree system on adaptive compact distributions," arXiv preprint arXiv:2001.09419

- Choi J, Jeong B, Park Y, Seo J, Min C (2018) An optimal boosting algorithm based on nonlinear conjugate gradient method. J Korean Soc Indust App Mathe 22(1):1–13 MathSciNetMATHGoogle Scholar

- Ganin Y, Ustinova E, Ajakan H, Germain P (2016) Domain-adversarial training of neural networks. J Mach Learn Res 17(1):2030–2096 MathSciNetMATHGoogle Scholar

- Ge D, Gu J, Chang S, Cai J (2020) "Credit Card Fraud Detection Using Lightgbm Model", in International Conference on E-Commerce and Internet Technology (ECIT), IEEE

- Gutierrez-Espinoza L, Abri F, Siami Namin A, Jones KS, Sears DRW (2020) "Fake Reviews Detection through Ensemble Learning.," arXiv preprint arXiv:2006.07912

- Hajela G, Chawla M, Rasool A (2020) A Clustering Based Hotspot Identification Approach For Crime Prediction. Procedia Comput Sci 167:1462–1470 ArticleGoogle Scholar

- Huang J (2020) "Credit card transaction fraud using machine learning algorithms," in 2019 international conference on education science and economic development (ICESED 2019)

- “IEEE-CIS Fraud Detection (2019)” Vesta, [Online]. Available: https://www.kaggle.com/c/ieee-fraud-detection. Accessed 13 Jan 2021

- Kavya D, Chitharanjan K (2019) Performance evaluation of credit card fraud transactions using boosting algorithms. Int J Electron Commun Comput Engin 10(6):262–270 Google Scholar

- Kim E, Lee J, Shin H, Yang H, Cho S, Nam SK et al (2019) Champion-challenger analysis for credit card fraud detection: Hybrid ensemble and deep learning. Expert Syst Appl 128:214–224 ArticleGoogle Scholar

- Kumari P, Mishra SP (2019) Analysis of credit card fraud detection using fusion classifiers. Comput Intel Data Mining:111–122

- Lebichot B, Borgne Y-AL, He-Guelton L, Oblé F, Bontempi G (2019) "Deep-learning domain adaptation techniques for credit cards fraud detection," in NNS big data and deep learning conference, Cham

- Liang Y, Jiyu W, Wei W, Yujun C, Biliang Z, Zhenkun C, Zhenzhang L (2019) "Product marketing prediction based on XGboost and LightGBM algorithm," the 2nd International Conference on Artificial Intelligence and Pattern Recognition, pp. 150–153

- Lucas Y, Portier P-E, Laporte L, He-Guelton L, Caelen O, Granitzer M, Calabretto S (2020) Towards automated feature engineering for credit card fraud detection using multi-perspective HMMs. Futur Gener Comput Syst 102:393–402 ArticleGoogle Scholar

- Md R, Rab A ( 2020) "A Comparative Study on Crime in Denver City Based on Machine Learning and Data Mining.," arXiv preprint arXiv:2001.02802

- Najadat H, Altiti O, Aqouleh AA, Younes M (2020) "Credit card fraud detection based on machine and deep learning," in 11th international conference on information and communication systems (ICICS),IEEE

- Polikar R (2012) Ensemble Learning, M. Y. Zhang C., Ed., Boston, Massachusetts: Springer

- Rahmadayana F, Sibaroni Y (2021) Sentiment analysis of work from home activity using SVM with randomized search optimization. Jurnal RESTI (Rekayasa Sistem dan Teknologi Informasi) 5(5):936–942 ArticleGoogle Scholar

- Raza M, Qayyum U (2019) "Classical and deep learning classifiers for anomaly detection," 2019 16th International Bhurban Conference on Applied Sciences and Technology (IBCAST), pp. 614–618

- Refaeilzadeh P, Tang L, Liu H (2009) Cross-validation. Encyclop Data Syst 5:532–538 ArticleGoogle Scholar

- Sadgali I, Sael N, Benabbou F (2019) "Comparative study using neural networks techniques for credit card fraud detection," The Proceedings of the Third International Conference on Smart City Applications

- Saia R, Carta S (2019) "Evaluating the benefits of using proactive transformed-domain-based techniques in fraud detection tasks," Future Generation Computer Systems, vol. 93

- Su C-H, Tu F, Zhang X, Shia B-C, Lee T-S (2019) A ensemble machine learning based system for MERCHANT credit risk detection in MERCHANT mcc misuse. J Data Sci 17(1):81–106 Google Scholar

- “type of credit cards (2021)” [Online]. Available: [https://www.thebalance.com/key-differences-between-visa-mastercard-discover-and-american-express-4588450#citation-4. Accessed 27 Mar 2021

- Yixuan Z, Tong J, Wang Z, Gao F (2020) "Customer transaction fraud detection using Xgboost model," in international conference on computer engineering and application (ICCEA), IEEE

Funding

There is not any fund for this research.